Comment period is underway through November 7The U.S. Department of Labor (DOL) is proposing a new threshold for overtime pay (1.5 normal earnings) for salaried employees earning up to $55,068. The current overtime threshold of $35,568 per year has been in place since 2020, making this a 55% increase ($19,500) to the federal salary threshold.

Salaried employees earning up to $55,068 per year will get overtime pay (1.5X normal earnings) when working over 40 hours a week, according to a new federal proposal. The current overtime threshold of $35,568 per year has been in place since 2020, making this a 55% increase ($19,500) to the federal salary threshold. Total cost: The U.S. Labor Department (DOL) estimates this will result in a “Year 1 income transfer” of $1.2 billion from employers to employees. How we got here: DOL sets a salary threshold to ensure eligible employees receiver overtime pay for all hours worked over 40 in a workweek. Using 2022 data, the newly proposed salary amount equals $1,059 per week, or $55,068 annually for a full-year worker. Leading Congressional Democrats have long supported federal overtime increases, as the Restoring Overtime Pay Act of 2023 proposes to raise the threshold to $75,000 per year by 2026. Red flag: The DOL’s proposed rule also seeks an automatic “update” of the salary threshold every three years. In the weeds: The DOL did not change the “standard duties test” to classify exempted administrative and executive positions. Next steps: The NRA will collect feedback and plans to submit comments by the November 7 deadline. The DOL will also host briefings on the proposal in coming weeks.

LRA members are encouraged to review Overtime Proposal FAQs and provide comments on the impact it will have on your restaurant or hospitality business.

1 Comment

You may have seen news stories about the saltwater intrusion in the Mississippi River and the impact it may have on the water supply of communities upstream. The LRA Team, along with the Louisiana Dept. of Health (LDH) Engineering Team, is working to prepare members for the impact this could have on our residents and restaurants, should the situation worsen. The LDH in conjunction with the U.S. Army Corps of Engineers (Corps) are collaborating on communication and the construction of a higher underwater dam to stem the flow of salt water upriver.

Here are a few things to consider:

Timeline Forecast: In discussion with the LDH Engineering Dept., the timeline forecast for the when the saltwater wedge reaches the intake at the following water systems is projected as follows: October 8 St. Bernard October 10 Algiers October 11 West Jefferson TBD Carrollton (New Orleans) Once the saltwater reaches the intake, it could be a few weeks before it could disrupt the water supply given the concentration of the water system’s chloride functions. This would not create a boil water advisory, as the issue with saltwater is not bacterial, but corrosion of plumbing systems, which may leach metals in the water supply. The LRA Team will continue to monitor this situation and provide updates as necessary. Metairie, La.— The Louisiana Restaurant Association (LRA) Acadiana Chapter celebrated the exceptional dedication of restaurant industry veterans at the Restaurant Legends Awards Dinner, hosted at Fezzo’s Seafood Restaurant & Bar on September 20, 2023. The LRA's prestigious Restaurant Legends Award recognizes foodservice, restaurant, and hospitality professionals who have displayed 20 or more years of unwavering commitment to their craft. This year's honorees included five remarkable team members from Fezzo’s Restaurant, boasting 111 years of combined service, and one outstanding individual from The Ground Pat'i Grille & Bar.

Randy Daniel, President of the LRA Acadiana Chapter (OMH Holdings), presided over the event and invited Rick Cambre, owner of The Ground Pat’i Grille & Bar, to share his thoughts on Rachel Jones, one of the honorees. "Since 2003, Rachel has epitomized consistency and dedication within our team," said Cambre. "She exemplifies hard work, a commitment to enhancing the customer experience, and an unwavering willingness to go above and beyond. Rachel's influence on our team makes her not just valued but beloved. She is truly deserving of the Louisiana Restaurant Legends award." Pat Bordes, Owner of Fezzo’s, joined the celebration to deliver heartfelt speeches about each of his five honorees. The honorees recognized for their extraordinary contributions are:

Pat Bordes, Owner of Fezzo’s, summed up the sentiment of the evening with a powerful statement: "Each of these honorees exemplifies the dedication, commitment, and passion that define the spirit of our industry. They are the heart and soul of our restaurant, and we are proud to have them as part of our Fezzo's family." For more information about the Louisiana Restaurant Association and its awards, please visit www.LRA.org. A new Louisiana law takes effect today to require employers to provide time off from work for medically necessary genetic testing and cancer screening. The new law also prohibits discrimination and retaliation against employees who take such leave. What do Louisiana employers need to know in order to come into compliance?

Employer Requirements Louisiana employers with 20 or more employees are now required to provide employees a day’s leave of absence from work to obtain medically necessary genetic testing or cancer screening. According to the law sponsored by Senator Royce Duplessis, the following apply:

Employee Obligations Employees should give at least 15 days’ advance notice to their employer prior to taking leave and make a reasonable effort to schedule the leave so as not to cause undue disruption of the employer’s business operations. Employees may be required by their employer to provide documentation confirming the performance of the genetic testing and/or cancer screening. However, employees are not required to disclose the results of the test or screening. An employer should not inquire about results either. Is This Paid Leave? Employers are not required to provide paid time off for genetic testing and/or cancer screening. Employees may elect to substitute any accrued paid time off that the employer provides. Remember that employees who are exempt under the Fair Labor Standards Act fall with the deduction laws set by federal law. What Should Employers Do Next? In addition to reviewing current leave and discrimination policies, there will be a new required workplace posting. The Louisiana Workforce Commission is tasked with creating and publishing this new poster. Stay tuned for a compliant poster to be released in the near future. Conclusion We will monitor developments related to this new law and provide updates as warranted, so make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information sent directly to your inbox. If you have questions, contact your Fisher Phillips attorney, the authors of this Insight, or any attorney in our New Orleans office. Sharp increases in food and labor costs are having a dramatic impact on restaurants’ bottom line.

Latest Economic Indicators:

The Restore Louisiana Small Business Loan Program is now accepting applications for small businesses and nonprofits affected by natural disasters in 2020 and 2021, Gov. John Bel Edwards announced today.

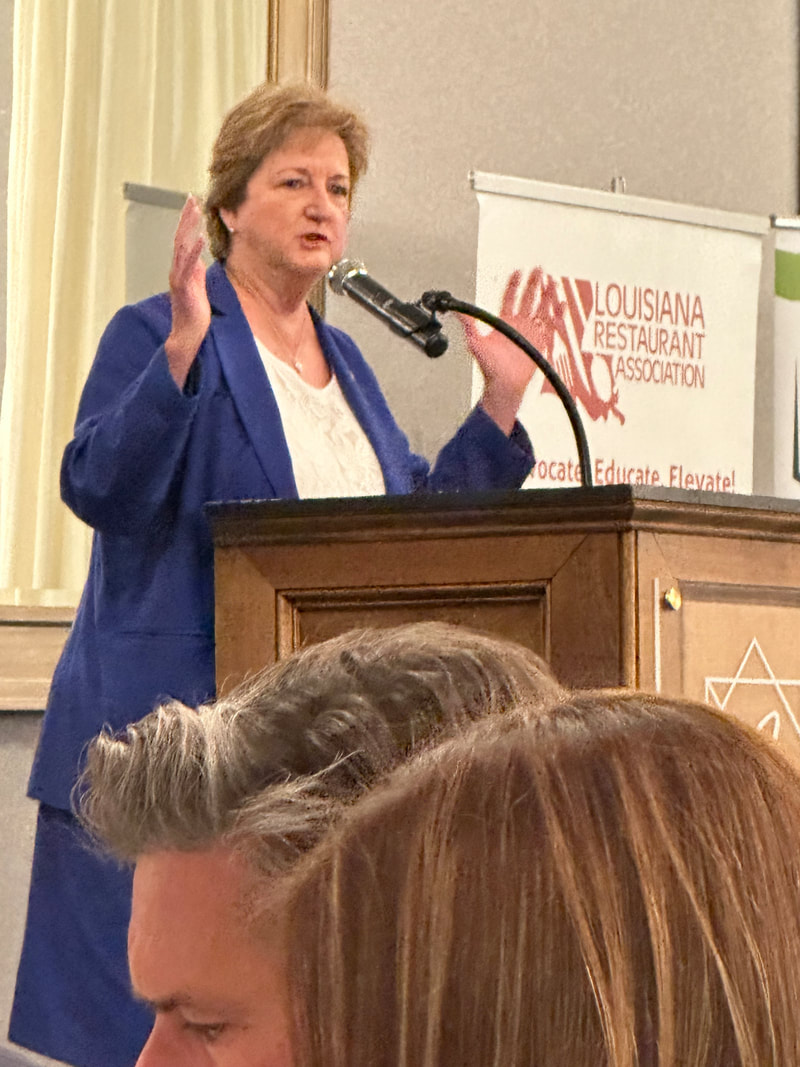

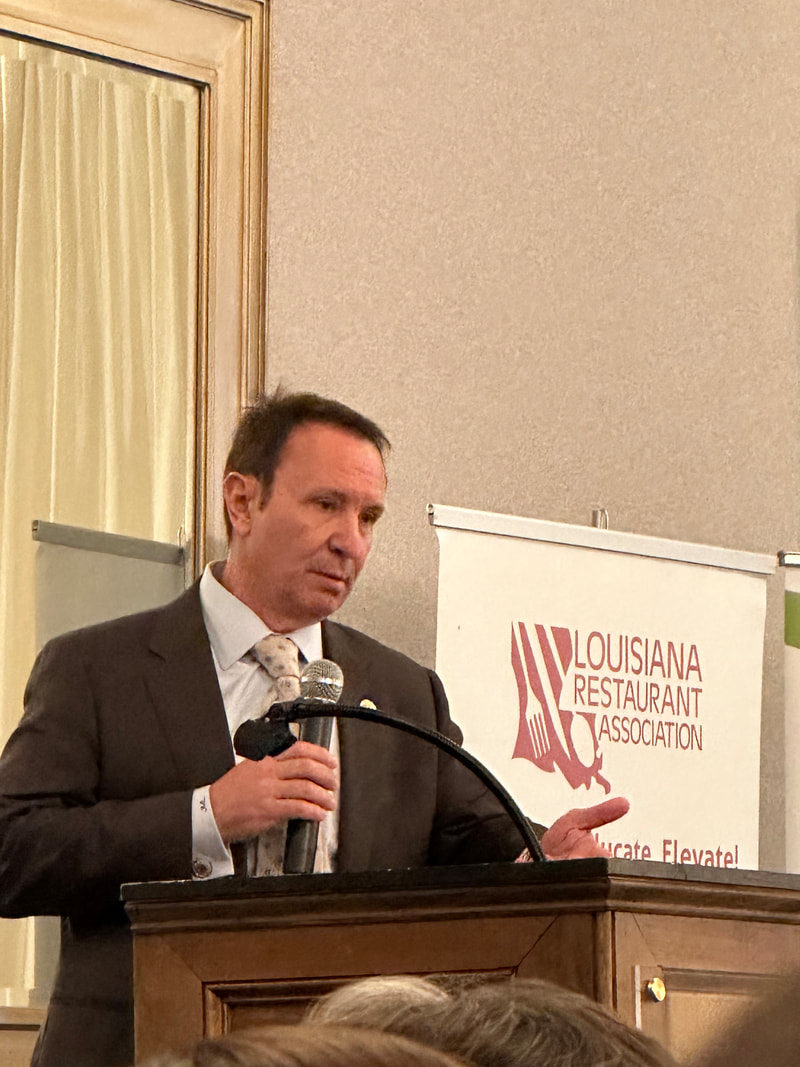

The federally funded lending program can cover nonconstruction expenses for eligible organizations. To qualify for a loan, businesses must have one to 50 full-time employees; have been open at the time of the disaster; have had a minimum of $25,000 in annual gross revenues before the disaster; be in one of the program’s eligible parishes, which includes East Baton Rouge, Ascension and Livingston; experienced a financial or physical loss as a result of a 2020-21 disaster; and have an eligible unmet need. Loan award amounts will range from $10,000 to $150,000, based on a calculation of unmet needs and eligible expenses. The state has allocated $96.1 million through the Small Business Loan Program, which is funded by the U.S. Department of Housing and Urban Development. The state has identified four nonprofit lenders to implement and administer the lending program throughout Louisiana—South Central Planning and Development Commission, Regional Loan Corporation, NewCorp Inc., and North Delta Regional Planning and Development District. Get more information about the loan program. Information From Baton Rouge Business Report With the 2023 Louisiana Legislative Session beginning Monday, April 10, the LRA, the Louisiana Retailers Association and NFIB held a gubernatorial forum at Juban’s Restaurant in Baton Rouge. It was the first event during this campaign season where all seven candidates shared their vision for what Louisiana’s priorities might be during their administration. Taxes were front and center of discussion for the audience of restaurant industry and small business professionals. Key topics included inventory, franchise, sales and income taxes. Several candidates focused on addressing our education system deficits so we can prepare our workforce for the jobs that will be available today, and in the future. The forum began with Senator Sharon Hewitt (R), who was elected in 2016 to represent the 1st district, which encompasses portions of St. Tammany, Orleans, Plaquemines and St. Bernard Parishes. Hewitt expressed her commitment to propelling the state forward by improving schools, reducing wasteful government spending and improving the overall quality of life for residents. In her role as Senator, she’s authored and passed one of the most significant literacy bills in the history of the state. As a career engineering executive with Shell, she has led the state’s efforts to invest in Science, Technology, Engineering and Math (STEM) education programs, which are designed to attract high paying jobs to our state and retain graduates beyond college. State Attorney General Jeff Landry (R) touted his experience as a small businessman before he was elected to serve in Congress. He noted he was the only advocate for small business and restaurants opposing the operating restrictions placed on the industry during the COVID-19 pandemic. Landry shared his vision for a Louisiana that needs to improve education, and restructure its untenable tax code. He also discussed the necessity to address crime, noting three cities in Louisiana are rated in the top ten for crime in the US. Hunter Lundy (Ind.) from Lake Charles has never run for state office. He built a multi-state law practice and sold his business to focus on the Governor’s race. He’s also owned restaurants and other businesses. He says, as an independent, he isn’t beholden to any party. He wants to see us address our infrastructure and education outcomes, while creating more training for future jobs that will encourage business to locate here. Richard Nelson (R), a first term House member from Mandeville District 89, noted that after living outside the state, he and his wife chose to raise their three sons back home. He spoke about our lack of a competitive measure for income tax when we look at our neighboring states. He discussed legislation he passed out of the House last year that would require 3rd graders to read at grade level by the end of the school year or be held back for remediation and further testing. He implored us to use the education system for outcomes that make our graduates desirable to employers. State Treasurer John Schroder (R) threw his hat in the race early this year drawing on his nine year experience in the House of Representatives and his almost six years serving as state treasurer. During the forum, he remarked that service in his current role, which focuses squarely on the state’s fiscal responsibility, makes him the best choice to lead Louisiana as its next governor. Ahead of the 2023 Legislative Session, he’s shared his position on how to best use the state’s revenue, and how to be more proactive against natural disasters. Schroder would specifically like to see the legislature create a disaster fund so that the state has more cash on hand to quickly respond to disasters. Additionally, he noted that we shouldn’t crack open the state’s reserves if fully funded unless it was for one time spending. Stephen Waguespack (R), is the former LABI CEO. He spoke on his success as chief lobbyist for the business community passing tort reform and pushing to consolidate Louisiana’s archaic sales tax collection system. Waguespack shared his memory of leaving Louisiana in the early 1980’s with his family as his father had to seek employment outside the state. He wants to create a vibrant economy that makes people want to be here, while providing the jobs needed to sustain them. For the past 10 years, he’s led LABI and been a leader in improving the tax and fiscal accountability in Louisiana. Lastly, attendees heard from Shawn Wilson (D), a Lafayette resident who has spent the last 25 years in government under democratic and republican governors. For the last seven years, he served as Edwards’ Secretary of Department of Transportation and Development, but stepped down from that position to run for governor. He spoke of the nearly 7,000 miles of roadways rebuilt or added, and funds secured to replace the 1-10 bridge over the Calcasieu River and gained the first tranche of dedicated funds to construct a new bridge over the Mississippi River in Baton Rouge. And while he has not held elective office, his vision for the future touched on education, job creation, tax reform and building a budget process that avoids wild dips like we’ve seen in previous terms. He also discussed seeking and deploying the remaining federal grant dollars from multiple programs that arose during Covid. He noted his historical approach to build bridges—both literally and figuratively. The primary election will take place on October 14, 2023. Should no candidate exceed 50.1% of the vote, the top two candidates in votes will face off in the runoff election on November 18, 2023. Top Row (pictured left to right) : Senator Sharon Hewitt (R), Shawn Wilson (D), Hunter Lundy (IND), State Attorney General Jeff Landry (R) Bottom Row (pictured left to right) : Richard Nelson (R), State Treasurer John Schroder (R) and Stephen Waguespack (R) Metairie, LA-- The Louisiana Restaurant Association Education Foundation (LRAEF) hosted the Raising Cane’s Chicken Fingers Louisiana ProStart® Invitational, March 29-30 at the New Orleans Morial Convention Center. Atmos Energy sponsored the Culinary Competition which showcased the culinary and creative abilities of ProStart students from 19 high schools, while BRG Hospitality sponsored the Management Competition, which featured the conceptual restaurant development and marketing ingenuity of ProStart students from 14 high schools.

During the Atmos Energy Culinary Competition, teams demonstrated their teamwork, communication, sanitation, knife skills and culinary techniques throughout the 60 minutes timeframe to prepare a three-course, gourmet meal. This was achieved with no electricity or water, and just two table top butane burners. The winner of the Atmos Energy Culinary Competition: Chalmette High School Instructor: Elena Hodges Students: Sharon Johnson, Nga Phan, Jhana Fisher, Marissa Gerrick, Henry Scheeler IV Chef Mentors: Anastasia Joyner Winning menu: Appetizer- Shrimp Remoulade with Fried Okra; Entrée- Cajun Surf and Turf; and Dessert- Vanilla Bean Crème Brûlée. Second Place – Culinary Competition: Lakeshore High School Instructor: Nicole Benefiel Students: Leah Slaton, Jaden Scott, Leah Underwood, Caroline St. Romain Third Place – Culinary Competition: Live Oak High School Instructor: Angell Beswetherick Students: Brittany Bennett, Braylee Boze, Luke Bozeman, Gavin Cadarette, Grant Starns Fourth Place – Culinary Competition: Sulphur High School Instructor: Jacob Gillett Students: Carson Brackeen, Avery Gorum, Kip White, Marie Racaa, River Lemley Fifth Place – Culinary Competition: Abbeville High School Instructor: Devin Romero Students: David Avila, Chloe Klein, Grace Landry, Ethan Matthews Teams participating in the BRG Hospitality Management Competition demonstrated their knowledge of the restaurant and foodservice industry by developing a restaurant concept, including the menu, design, budget and marketing strategies, which they presented to a panel of judges as an entrepreneur would pitch to a group of investors. The winner of the BRG Hospitality Management Competition: Chalmette High School Instructor: Elena Hodges Students: Vernon Patrick, Kim Nguyen, Frankie Padilla, Joshua Farrell, Ronnie Truong Winning restaurant concept: Seaux, a Southern Louisiana and Southeast Asia fusion restaurant Second Place – Management Competition: West Feliciana High School Instructor: Delanea Buffalo Students: Emma Cutrer, Cayden Summers Third Place – Management Competition: W.D. & Mary Baker Smith Career Center Instructor: Theresa Edwards Students: Wacovia Isaac, Serenity Portalis, Marilee Presley Fourth Place – Management Competition: Hammond High Magnet School Instructor: Angelina Drago Students: Dallas Griffitt, Kaylee Stewart Fifth Place – Management Competition: Plaquemine High School Instructor: Stephanie White Students: McKenzie Justillian, Mackenzie Anderson, Natalie Carline, Keaira Hamilton Chalmette High School will represent Louisiana at the National ProStart Invitational in Washington, D.C. May 2-4, 2023 where they will compete for more than $1 million in additional scholarship dollars. The 2022 LRAEF ProStart Student Invitational Sponsors are: Raising Cane’s Chicken Fingers, Atmos Energy, BRG Hospitality, Republic National Distributing Company, Sodexo Live!, QED Hospitality, NATCO, Coca-Cola Bottling Company-United, Auto-Chlor System, PJ’s Coffee, Ecolab, Freeman Decorating, Community Coffee, and the New Orleans Morial Convention Center. The 2022 LRAEF Annual Partners are: Raising Cane’s Chicken Fingers; the Baton Rouge Epicurean Society; Auto-Chlor System; Acme Oyster House; The Emeril Lagasse Foundation; Ecolab; BRG Hospitality; The Louisiana Restaurant Association; Tabasco; The National Restaurant Association Educational Foundation; Atmos Energy; BlueRunner; The ForeKids! Foundation; B&G Food Enterprises; JP Morgan Chase & Co.; Sysco; The Lester E. Kabacoff School of Hotel, Restaurant and Tourism Administration at the University of New Orleans; NATCO Food Service; Republic National Distributing Company; QED Hospitality; The Octavio Mantilla Family Trust; and Entergy Louisiana. In addition, the LRAEF would also like to thank the nine chapters of the LRA for their support throughout the year. ProStart is a nationwide, two-year culinary arts and restaurant management program for high school students that develops the best and brightest talent into tomorrow’s restaurant industry leaders. By uniting the classroom and the industry, ProStart gives students a platform to discover new interests and talents and opens doors for fulfilling careers. Students are required to complete a 400-hour work internship, thus providing hands-on training. ProStart is important because it provides a pathway to a student’s future success, providing a foundation for a variety of career choices—from management and culinary operations, to supply chain positions and marketing support. The possibilities are endless in an industry with many facets. Many LRA members serve as mentors to ProStart students and also hire them. 3rd party delivery apps must have an executed contract to use your logo or likeness

Restaurateurs, we’ve been advised by an LRA member that a third-party delivery provider has listed their restaurant on the app without permission. This business has no affiliation or contract with this delivery service. They’ve been contacted by several people using the app seeking a refund because the food was never delivered. During the 2020 Louisiana Legislative Session, the LRA passed Act 192 which prohibits a third-party delivery service from representing a restaurant on their platform, unless there is an executed contract between the parties. This means they can’t use your logo on their website, or in an internet search. The law also stripped the “indemnification” provisions from any agreement with a third-party delivery contract effectively making it unenforceable in Louisiana (regardless of the contract language.) Your protection allows for a private right of action against the third-party delivery provider that may be mis-representing they have a contract with you, or are simply trying to re-direct an unsuspecting guest of your restaurant to their platform or app. This private right of action allows you to sue the third-party delivery company to seek civil damages of up to $5,000 plus attorney fees. Metairie, LA—The Louisiana Restaurant Association Education Foundation (LRAEF) Board of Directors, through its Scholarship Fund, will award $60,000 in scholarships to 22 students. The LRAEF Scholars were honored at “Serving the Future—Celebrating Careers in Hospitality,” March 29, 2023 at Generations Hall in New Orleans.

The LRAEF Scholarship Fund was created in 2009 to provide financial support for individuals interested in furthering their education to support a career in the culinary, hospitality, or related industries. Since its inception, the Scholarship Fund has awarded over $600,000 to deserving students. The LRAEF’s most-prestigious award, the Jim Funk Scholarship, is named for the former LRA President & CEO who guided the creation of the LRAEF during his 30 years with the organization. This year’s recipient of the Jim Funk Scholarship is Morgan Boquet. She is a 4th year LRAEF scholar (2020, 2021, 2022, 2023), attending the Chef John Folse Culinary Institute at Nicholls State University, and is a ProStart graduate of Lakeshore High School in Mandeville. The Louisiana Seafood Scholarship was established through a generous gift from the Louisiana Seafood Promotion & Marketing Board and is awarded to a qualified applicant who expresses an interest in cultivating, protecting and promoting Louisiana Seafood. This year’s Louisiana Seafood Scholar is Zoe Foster, who is a 3rd year LRAEF scholarship recipient (2021, 2022, 2023), attending the Chef John Folse Culinary Institute at Nicholls State University. The LRAEF Scholars are individuals who intend to pursue a career in the restaurant, foodservice, tourism, or hospitality industry. ProStart students, who have or will receive the National ProStart Certificate of Achievement are given top priority. This year’s LRAEF Scholars are:

“Honoring the LRAEF Scholars during Serving the Future is a favorite part about my role as Chair of the LRA Education Foundation,” said LRAEF Chair Jason Jones, Sysco. “Meeting them in person, and hearing how passionate they are about a career in restaurants and hospitality, and then seeing their face light up as they accept their scholarship is so rewarding. These scholars are the future leaders and innovators of our industry.” -30- ProStart is a registered trademark of the National Restaurant Association Educational Foundation. ProStart is a two-year, culinary management program for high school juniors and seniors with a curriculum designed to teach students culinary techniques as well as restaurant management skills. ProStart is in 58 high schools statewide and more than 2,000 students participate in the program. The Louisiana Restaurant Association Education Foundation exists to enhance the industry’s service to the public through education, community engagement and promotion of career opportunities. The Louisiana Restaurant Association is one of the largest business organizations in the state, representing restaurant operations and related businesses. The restaurant industry in Louisiana is one the state’s largest private employers, providing jobs to 207,700 residents. Restaurants in Louisiana generated sales of $8.9 billion in 2017. Get up-to-date news about the LRA and the restaurant industry from www.lra.org. Are your surcharges souring your customers’ dining experience?

During a weekend trip to Acadiana and several dining experiences there and back, we were caught off guard by the practice of surcharge options for credit card payments. At two different locations, we were hit with a four percent surcharge on our bill – one we were advised ahead of time as it was posted on the menu. At the second location, it was posted on the entrance door, however, we missed it. Neither provided a receipt that indicated the charge, which is a requirement. Here are a few things to remember if you are considering this or doing it at present to be compliant. While adding surcharges to the cost of a purchase is legal in Louisiana, each credit card brand has its own rules that merchants must adhere to. Our partners at Heartland Payment Systems have a thorough article to review here. Some of the guidelines include:

Be careful in changing processors without understanding the exposure you could have to your existing processor under liquidated damages for a breech or early termination of an existing processor agreement. And, remember to read your merchant agreement with Visa, MasterCard and Amex. There are some that require you to provide advance notice to the processor before instituting these charges. Our payment system partner Heartland has a new POS system that can help you with compliant processing of any surcharge, and avoid those on debit transactions. And, accept that you have the risk of a guest choosing to frequent another restaurant for one that doesn’t use surcharging and instead includes its total operating costs in the menu price. Download the State of the Industry report on Restaurant.org.

The report is free to members and $349 nonmembers. During the purchase process, login with your previously established email address/password or select Create Account. Use the same email on your membership to ensure it syncs with your existing member record. The Create Account feature will also show if the email has an existing login. The login for Restaurant.org is different than LRA.org. If you are still receiving the non-member rate after creating an account, please contact [email protected] and request for your account to be linked to your company’s membership. Metairie, La.--The Louisiana Restaurant Association Self Insurer’s Fund for Workers’ Compensation announces rate reductions effective March 1, 2023.

The LRA SIF offers workers’ compensation coverage specializing in the hospitality industry and the rate reduction applies primarily to businesses in this sector focused on restaurants. Management believes this rate reduction should be attractive to our restaurant members in these challenging economic times. “In this highly competitive marketplace, the LRA SIF Board of Trustees is pleased to approve and implement this rate reduction which will assist members of the Fund with managing their overall cost of operations,” said Stan Harris, President and CEO, LRA SIF. If you have restaurant clients who may benefit from this rate reduction, please contact the LRA Workers’ Comp program at [email protected]. Since its inception in 2008, the Louisiana Seafood Cook-Off (LASCO) has been at the top of the list of professional culinary competitions. Competing chefs line the stage in this live cooking, fast paced, culinary throw down. Chefs from all corners of the state come together in one arena to compete for the winning crown. In addition to earning the title of King or Queen of Louisiana Seafood, the winner goes on to represent the state at a variety of events including the Great American Seafood Cook-Off. Winning the Louisiana Seafood Cook-Off has been known as a "culinary catapult" amongst industry members. With past winners going on to open their own "brick and mortar" establishments, hosting their own culinary television shows, gracing the covers of magazines across the nation and more!

Join us on Tuesday, June 27th, 2023 at the Golden Nugget in Lake Charles, Louisiana to find out who our next culinary champion will be. Instructions for Applicants: • Entrants must be an executive chef for an acclaimed, free-standing Louisiana restaurant. Restaurants associated with a luxury country club, resort or hotel are also eligible. • Restaurant must be a member of Louisiana Restaurant Association. • Institutional chefs, i.e., food service distributors, hospitals, culinary school instructors, caterers or corporate chefs for chains having 10 or more restaurants are not eligible. • Each chef will be responsible for plating five (5) entrées for judges with Louisiana seafood as the main protein. • Each chef will receive a $250 stipend to assist with ingredient costs, travel, and time away from his/her restaurant. In addition to the stipend, a hotel room will be offered for each competing chef for two nights. • There are twelve (12) spots available and entry forms will be accepted until end of the business day of Monday, May 15, 2023. • All submissions will be reviewed and selected by a committee of the Louisiana Seafood Promotion and Marketing Board. Contestants will be notified of their eligibility by Tuesday, May 23, 2023. Click Below for ATC Guide!

|

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

September 2023

Categories |

RSS Feed

RSS Feed